Following the frenzied competition of post-pandemic years, demand for residential land has plunged—a clear sign that builders are pulling back as profit margins shrink.

And this shift does not bode well for the future of new-home construction in the U.S., according to a new report from John Burns Research and Consulting.

“After two years of fierce competition, land demand has collapsed by nearly two-thirds,” writes Dillan Krieg, a senior research analyst specializing in surveys at John Burns.

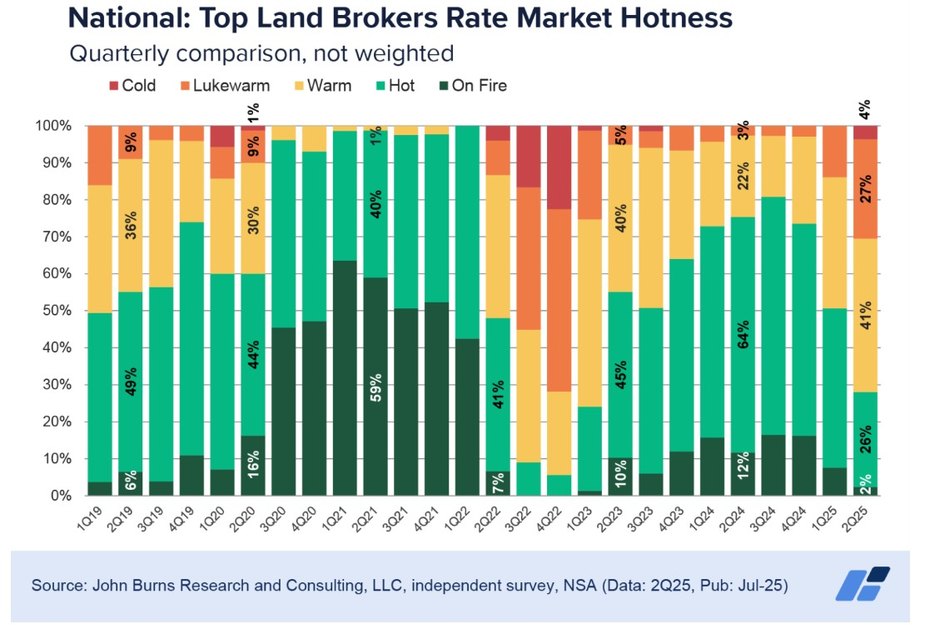

The latest data from the housing industry analytics firm show that only 28% of land brokers reported strong demand for lots in the second quarter of 2025, down from 76% a year ago. The last similarly dramatic drop in demand was recorded in late 2022 during the pandemic.

For comparison, at the start of the year, half of surveyed brokers reported robust demand in their markets.

Krieg explains that the softening demand is driven by the fact that lot prices “have been slow to adjust to declining builder profitability.” Simply put, the cost of land remains high, even as builders struggle to command top dollar for their completed homes.

“Land prices typically lag the broader housing market,” Krieg tells Realtor.com®. “In particular, many raw land sellers hold out for their preferred price and are willing to wait if they don’t need to sell. For finished lots, though, low supply is a big factor keeping prices up.”

Land prices tick up as demand sags

Developed, ready-for-construction, land has been in relatively short supply over the past few years in many markets due to regulatory barriers, so competition persists even with softening demand, notes Krieg.

In the post-COVID era of strong profit margins, builders were willing and able to shell out more for land as they focused on churning out homes for sale—but then came the slowdown.

While new-home prices were down 1% nationally in Q2 2025 from a year ago, lot prices increased between 4% to 6% annually, depending on the location.

In June, the typical new-construction home sold for $407,200, or roughly $28,000 less than an existing home, marking the biggest inversion in at least 25 years.

Last month, the price gap between new and preowned homes narrowed to $19,000, representing a sizeable 4% discount on new construction—an unprecedented shift.

Additionally, about 80% of brokers surveyed by John Burns reported more transaction cancellations and renegotiations than normal in spring and early summer 2025—a sign that deals that made financial sense six months ago no longer work in today’s stalled market, where buyers and sellers find themselves in a standoff.

Comments (2)

Carroll Goldner

I just wanted to express my gratitude for the valuable insights you provide through your blog. Your expertise shines through in every word, and I’m grateful for the opportunity to learn from you.

ipurchaseuglyhouses

thanks for so much